Solo Business Owners: The Hidden Power of the Mega Backdoor Roth

If you’re self-employed and earning a solid income, you’ve probably hit the limits of how much you can stash away in a Roth IRA. The standard “backdoor” Roth allows just $7,500 per year ($8,600 if age 50+).

If you are unfamiliar, A backdoor Roth IRA is its own blog post in and of itself. For today's purpose, we will keep it simple by defining a backdoor Roth as contributing the maximum amount into a Traditional IRA as an after-tax, non-deductible contribution, and then converting those same funds into a Roth IRA. Ultimately, this allows for tax-free growth of the funds. Be wary, you need to know about the pro rata rules and reporting requirements.

But what if you could move ten times more into Roth dollars, legally, efficiently, and without hiring a single employee?

That’s exactly what the Mega Backdoor Roth can do for solo business owners.

Why Roth Can be Superior

Roth accounts are the ultimate “pay tax now, and never again” tool.

You pay taxes on contributions up front, but once your money is in a Roth, all growth and withdrawals are tax-free if you follow the distribution rules.

In contrast, traditional 401(k)s are tax-deferred — you get a deduction now, but every future withdrawal is taxed as ordinary income. Sufficient to say, Roth can provide significant appreciation tax-free.

The Problem: Standard Roth Limits Don’t Cut It

The IRS limits direct Roth IRA contributions once your income exceeds $153,000 (single) or $242,000 (married filing jointly) in 2026.

The regular backdoor Roth IRA helps you fund a Roth IRA despite those income limits, but for only $7,500 ($8,600 a year if you are above the age of 50).

Solo business owners, however, have a better play: using their solo 401(k) to make after-tax contributions and immediately convert those funds to Roth.

This is called the Mega Backdoor Roth, and it can allow up to $72,000 per year in total 401(k) contributions ($80,000 if 50+), depending on your plan.

How This Is Possible

A Mega Backdoor Roth is possible because the IRS allows total annual contributions to a 401(k), including employee deferrals, employer contributions, and voluntary after-tax contributions, up to the overall “annual additions limit” ($72,000 for those below 50). Once you’ve maxed your employee deferral ($24,500 for 2026, or $32,500 if 50+ and $35,750 if 60 to 63), you can still contribute voluntary additional after-tax dollars to reach that total limit. Those after-tax dollars can then be converted to Roth, either inside the plan or rolled to a Roth IRA, effectively turning the excess 401(k) space into Roth contributions.

Bypassing the Employer Pre-Tax Contribution

If it is your goal to fully fund a mega backdoor Roth, you will have to skip out on those employer contributions.

Why?

Because the employer portion:

Must be pre-tax (you’ll owe taxes later), and

Consumes part of your 401(k)’s annual additions limit, leaving less room for the after-tax → Roth funds.

When your goal is to build your “Roth bucket” on your balance sheet, not pre-tax, skipping employer contributions can actually increase your total Roth space.

The Mega Backdoor Roth Process

Fill the maximum employee contribution via Roth deferral: $24,500 (or $32,500 if age 50+ and $35,750 if 60 to 63)

Once filled, fund the plan with voluntary after-tax contributions of $47,500

Convert after-tax dollars immediately to Roth (in-plan or via Roth IRA rollover)

This would allow you to get $72,000 (or more if above catch-up age) into a Roth, primed for tax-free growth.

Now, let's say you continued to contribute using your employer's pre-tax contribution:

Fill the maximum employee contribution via Roth deferral: $24,500 (or $32,500 if age 50+ and $35,750 if 60 to 63)

Employer contribution: $20,000 (pre-tax)

Voluntary after-tax contribution: $27,500

Convert the after-tax contributions of $26,500 into Roth

The result is $20,000 stays pre-tax, reducing Roth capacity and adding future tax liability. Albeit, you would get a tax deduction for the pre-tax portion.

If your goal is to maximize Roth savings, foregoing pre-tax employer contributions is of the essence.

Putting the Numbers in Perspective

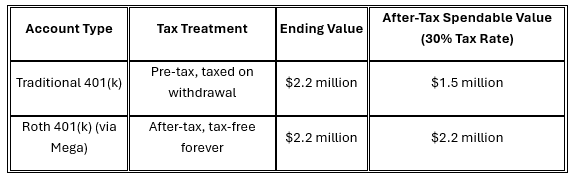

Let’s compare 20 years of saving $60,000 per year with 6% annual growth:

By skipping employer contributions and maximizing Roth capacity, you potentially create $2.2 million in tax-free wealth over two decades. Of course, and this is a very important distinction, you are increasing your current tax bill by no longer contributing pre-tax.

Considerations Against Contributing to a Roth

It's not all sunshine and rainbows with heavy Roth contributions. In fact, it is a possibility that contributing to the 401(k) on a pre-tax basis would result in a higher net after-tax amount, particularly if your tax rate is higher now than it would be in retirement. But, there are other benefits of Roth:

There are no required minimum distributions

You can withdraw your original contributions, not the earnings, tax, and penalty-free

Your heirs can inherit the Roth free of tax

Compliance Checklist

Before diving in, you need a 401(k) that:

Allows after-tax contributions

Permits in-plan Roth conversions or in-service rollovers

Tracks contribution sources separately (Roth, pre-tax, after-tax)

Executes conversions promptly to avoid taxable earnings buildup

If your solo 401(k) doesn’t support these features, consider a custom plan document; it’s the foundation of the strategy.

Who Benefits Most

The Mega Backdoor Roth is ideal for:

Solo business owners with strong cash flow

Tax-aware savers seeking long-term flexibility

If you’re building long-term wealth and want to minimize future tax exposure, this strategy could be a cornerstone of your retirement plan.

The Mega Backdoor Roth isn’t about loopholes; it’s about designing your solo 401(k) intentionally.

By bypassing the employer contribution and filling your maximum plan allowance “bucket” with after-tax dollars, you can convert to a Roth, and you turn your business into a Roth-funding machine.

When structured correctly, you’ll have:

Maximum Roth capacity

Full tax-free growth potential

Long-term control over your retirement income

Author: Dustin Burkhart, CFP®, EA

This material is purely intended to be general and educational in nature, and should not be construed as specifically-tailored investment, financial planning, tax, legal, or other professional advice. Information and data contained herein is as-of the date of publication, and may be subject to change in the future without notice. Any investment performance referenced is purely past performance, which is no guarantee of any future performance. Nothing contained herein should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or other financial product or investment strategy. All investment, tax, and financial planning strategies involve risk that you should be prepared to bear. You are highly encouraged to consult with professionals of your choosing before taking any action based on this material.