Can you work while taking a 72t distribution?

When you contribute to your retirement accounts, you probably picture locking away the money until 59 ½ when you can withdraw it penalty-free. But what if circumstances change and you need to access your funds sooner?

Maybe you had a recent career change or want to retire early. Enter the 72(t) rule.

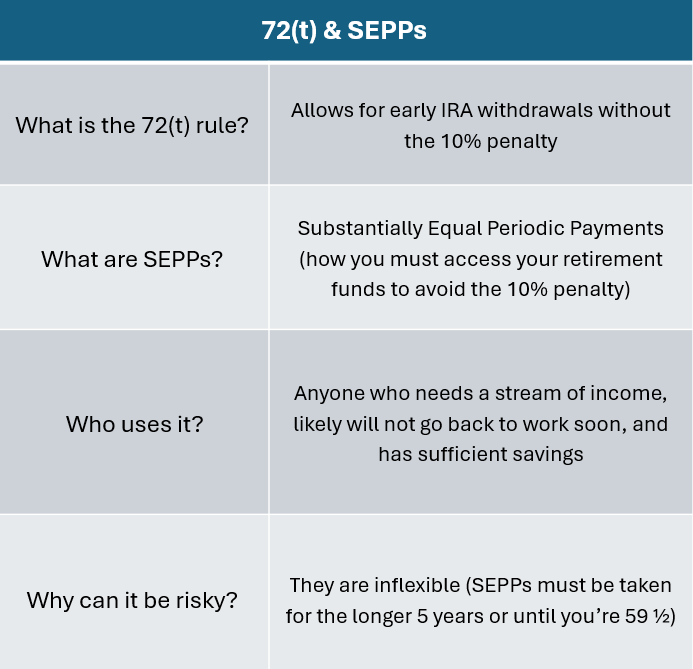

The 72(t) rule comes from section 72(t) of the Internal Revenue Code, and it allows for penalty-free early withdrawals from retirement accounts.

To avoid the usual 10% penalty, you must access the money by taking SEPPs (substantially equal periodic payments). These must be made (at least) annually and continue for the longer of 5 years or until you turn 59 ½.

For example, if you start at age 50, you’re locked in until 59 ½. If you start at 57, you’re locked in for 5 years (even though you’ll be older than 59 ½ before it ends).

Who takes advantage of the 72(t) Rule?

While anyone with a traditional IRA can use the 72(t) rule, it tends to be used mostly for:

Early Retirees

If you’re a high earner in your early 50s, you might have saved enough to retire and need to access your retirement funds before 59 ½ to do so.

Career Changers or Layoffs

If you change careers or get laid off, you might need to access retirement savings early to stay afloat until Social Security or other income source kicks in.

Business Owners or Entrepreneurs

If you start a business, you might want to use your retirement savings to fund it and/or support yourself during the startup phase.

Unexpected Expenses

Some people who are still employed and not planning on retiring soon might turn to 72(t) to access funds in case of an unexpected expense, like buying a second home or for a medical emergency.

While SEPPs are commonly taken by early retirees, you can still be employed and take them (like with the above examples of entrepreneurs/for unexpected expenses). It’s rarer but not impossible.

However, if you’re employed the SEPPs need to be taken from an IRA. You wouldn’t be able to take SEPPs from a 401(k) with your current employer.

How does 72(t) work?

You will calculate your SEPP using one of three methods:

Required Minimum Distribution (RMD)

Uses your account balance and life expectancy. It normally results in the smallest annual payments and recalculates each year.

Fixed Amortization

Spreads your balance over your life expectancy with a fixed interest rate. Your payment is calculated once and then is fixed.

Fixed Annuitization

This is similar to amortization but uses an annuity factor instead of life expectancy tables. Payments are also fixed.

Calculations will vary depending on factors like the life expectancy table used and chosen interest rate. For the purposes of this article, the above explanations will suffice but SEPPs should always be calculated by a financial professional.

Let’s say Sarah is 52 and wants to retire early. She has a $1.2M IRA and $300k in a taxable brokerage account. She needs about $60k a year to live on.

Using the fixed amortization method, her advisor determines she can take $50k per year from her IRA. The other $10k will come from her brokerage account. Her advisor also reallocates a portion of her IRA into a less aggressive model to protect her income stream.

This plan balances her income needs and leaves her enough flexibility to handle emergencies. In Sarah’s case, 72(t) is a tool and not a desperation move.

So, when would 72(t) be a desperation move? When is it a bad idea?

You Don’t Have a Safety Net

Once you commit to 72(t), it’s not very flexible. If you change or stop the payments early, the IRS retroactively applies the 10% penalty to all previous distributions, plus interest.

Market Volatility

If your IRA is invested in stocks and takes a dive, you might have to withdraw more than you can afford because the SEPP amount doesn’t change, even if your balance does (except under RMDs).

You May Go Back to Work

If you're using 72(t) to bridge a job gap but might return to work soon, locking yourself into SEPPs might be unnecessary and restrictive.

Remember, the 72(t) rule lets you avoid the 10% early withdrawal penalty, but the withdrawals are not tax-free. SEPPs are still subject to income tax.

This can have ripple effects on your overall tax picture. For example, it might bump you into a higher bracket, affect your eligibility for tax credits, or increase your Medicare premiums down the road.

72(t) has important implications for your tax life and in your overall financial life, especially in relation to liquidity and asset allocation.

If you’re retiring early or facing an income gap, 72(t) can help you generate income. But again, SEPPs should not be taken without proper planning because of their lack of flexibility. You’ll want to fully consider other income streams and other savings you may have.

Because SEPPs lock you into a distribution schedule, your investment strategy may need to change. You may want to have a less aggressive, more balanced portfolio so that you don’t have to sell in a down market to meet your SEPP obligation.

Using 72(t) in conjunction with Roth conversions, capital gains strategies, or Social Security timing can be powerful, but can be costly if not coordinated carefully.

SEPPs are not something to enter lightly. They’re a commitment that has lasting effects on your financial plan. As always, we recommend working with a tax professional who understands both tax strategies and wealth management.

Author: Rob Cucchiaro, CFP®, CRPC, AAMS

Questions answered in this article:

What if I need to withdraw from my retirement accounts before 59 ½?

What are SEPPs?

What is the 72(t) rule?

Who commonly uses the 72(t) rule?

What age can you withdraw from 401k without penalty?

How much is taxed on 401k early withdrawal?

How to calculate my SEPPs?

When is using the 72(t) rule not a good idea?

Do I owe income tax on SEPPs?

Should I change my portfolio model before taking SEPPs?

When can you withdraw 401k without penalty?

Can you work while taking a 72t distribution?

When can I withdraw my 401k without penalty?

How to withdraw IRA without penalty?

How to set up a 72(t) distribution?